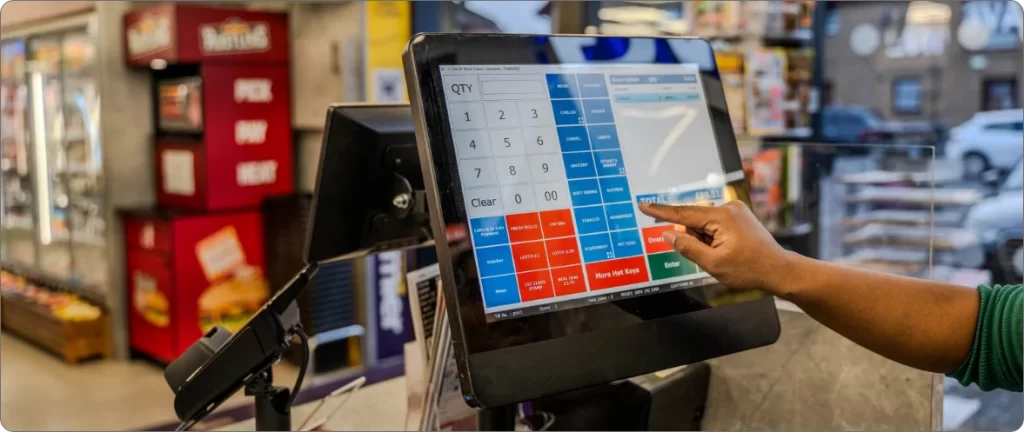

Best practices for managing inventory in a convenience store with an EPOS system

Managing inventory in a convenience store can be a challenging task. A variety of items are sold in a small space, and the need to keep track of stock levels, order new items, and prevent overstocking is critical to the success of the business. In this article, we will discuss the best practices for managing inventory in a convenience store with an EPOS system.

The Power of In-store Branding through POS Displays

POS displays are an effective way for businesses to communicate their branding and messaging to customers at the point of sale. In-store branding is a critical aspect of the marketing mix and is vital for increasing brand awareness and customer loyalty. POS displays offer a great opportunity for businesses to showcase their products and promotions in a way that engages customers and drives sales.

How to Streamline Purchase Order Approval Processes

The purchase order process is a critical part of any business that involves procuring goods and services. It is essential to have an efficient purchase order system to ensure that businesses can manage their purchases, avoid errors, and reduce delays. In today’s digital age, businesses can streamline the purchase order process by using digital purchase order systems and EPOS systems. This blog will explore the benefits of digital purchase order systems and EPOS systems for streamlining the purchase order process and improving business efficiency.

The Rise of Cashless Transactions and Its Implications for Businesses and Consumers

In recent years, the use of cashless transactions has seen a significant rise globally. Cashless transactions refer to any form of payment that does not involve physical currency exchange. The introduction of digital payment methods has led to the adoption of cashless transactions by both businesses and consumers. This article examines the rise of cashless transactions, its implications for businesses and consumers, and the importance of using EPOS hardware for cashless transactions.

The Role of Technology in Modern Inventory Management Systems

In today’s fast-paced business environment, managing inventory has become a critical aspect of any organization’s operations. With the growth of e-commerce, supply chain management, and globalization, inventory management systems have become more complex and demanding. The role of technology in modern inventory management systems cannot be overstated. This article explores the importance of inventory management, the benefits of inventory management for retail businesses, and how technology has evolved to help with inventory management.